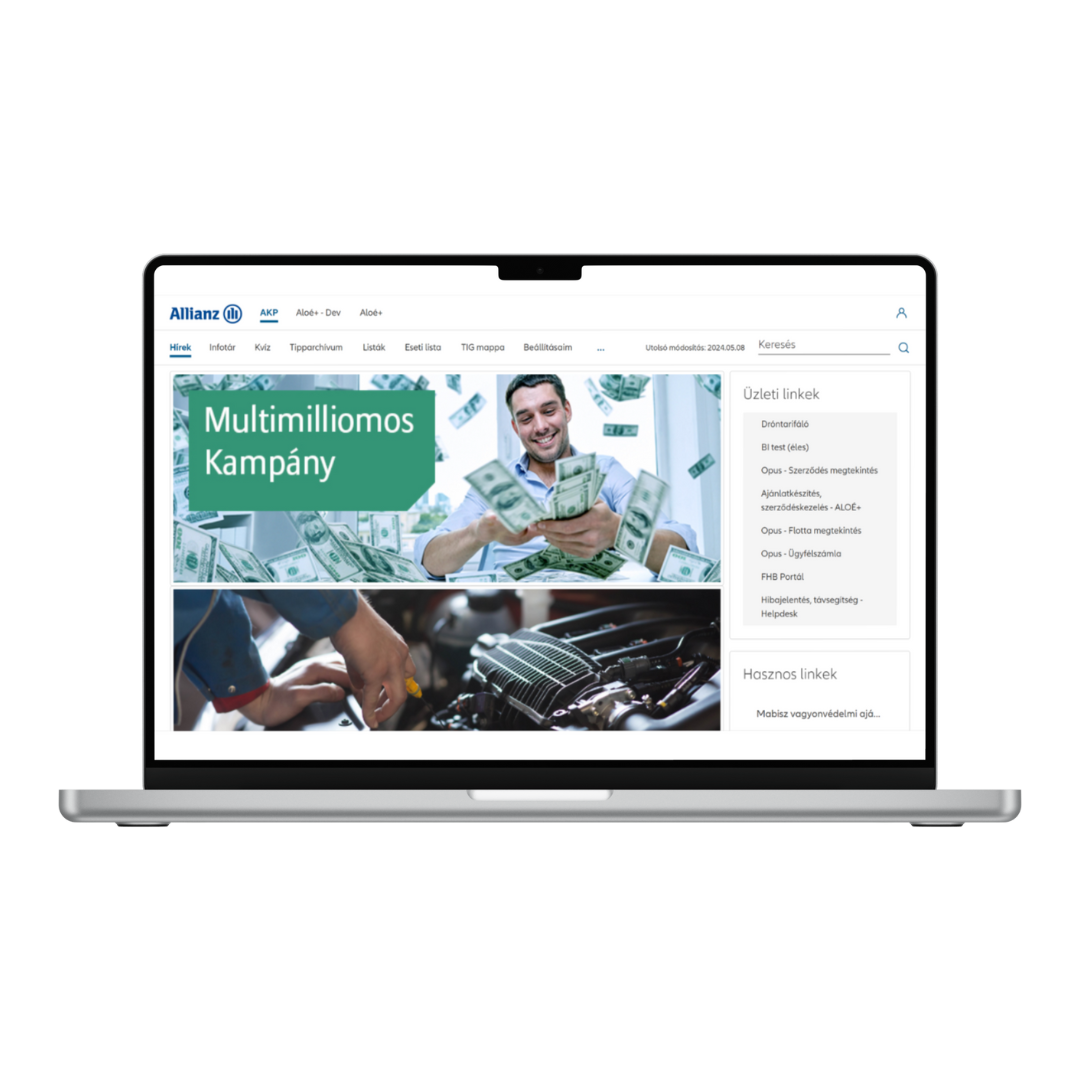

Allianz Unified Agent Portal: Agent Frontend with Knowledge Portal and Product Catalog

The Client

With over 157,000 employees worldwide, Allianz Group is one of the world's leading insurers and asset managers, serving 125 million customers in almost 70 countries. Allianz Hungary is the largest insurance provider in the Hungarian market, offering a wide range of services to both private and corporate clients. In addition to excelling in online customer service, they are also accessible at 239 physical touchpoints throughout the country.

The Challenge: How to build a digital solution that successfully supports the sales and client nurturing efforts of agents? How to create a user experience that attracts younger generations to join as agents?

The primary business challenge was to enhance agent efficiency through improved digital tools and streamline product-related trainings. The aging workforce presents a significant issue for insurers, making it crucial to appeal to young professionals. Product information at Allianz was scattered, and administrative tasks required separate systems. From a technical standpoint, a unified frontend needed to be developed in a highly heterogeneous, fragmented environment.

The Solution

Phase 1: Unified Agent Portal (2011)

In order to stay up-to-date, insurance agents require access to a broad spectrum of information, including: product descriptions, terms and conditions documents, marketing collateral, offer and contract templates, tutorials, online training materials, news, and distributed communications.

Additionally, they need access to numerous business functions implemented across various IT systems, such as: CRM, customer and contract management, insurance calculators, customer and contract-related reports, commission statements, and complaint management.

Together with Allianz, we identified three main requirements:

- All-In Self-Service: Agents must be able to access all necessary product information.

- Unified Frontend: Single point of entry for all systems used by agents.

- User-friendly solution.

The Unified Agent Portal is connected to all product information sources. It has a product catalog part and all other systems like the broker frontend and calculator frontends have been integrated. Agents can access all information, systems and can start any transaction they need.

Based on the requirements, leveraging some of our existing components as building blocks, we successfully delivered the first version of the frontend system within 4 months. This system is constructed on an extensible frontend framework, enabling rapid and modular incorporation of new functions, as well as seamless integration of loosely-coupled third-party applications.

At the core of the solution lies our product-centric Content Management System (CMS), which serves as a centralized platform for editing, maintaining, and publishing the product hierarchy, along with product descriptions and downloadable support materials (such as condition lists, brochures and contracts) showcased on the Agent Portal. Content owners manage information and set user permissions via an intuitive interface.

The solution became popular and garnered positive feedback from the agent network of over 7000 users.

During the implementation phase, the functionality of claim processes remained unaffected, with the system staying stable and operational throughout. Any necessary bug fixes and required changes were promptly implemented to ensure smooth functioning.

Phase 2: Technical Upgrade, Functional Expansion: Partner Portal (2021)

After 8 years of stable operation, it became timely to modernize the Agent Portal and align it with the newly introduced Group standards. To address this, our team undertook a complete rewrite using a more modern stack while preserving existing data and databases, ensuring seamless continuity in operations.

When the rewrite took place, cloud migration was also a goal. The original system was designed for on-premise infrastructure using IBM Websphere and Java EE, but the new stack was built on Spring, Angular and a containerized runtime environment. Initially, the containerized solution operated on-premise, but when the cloud migration project arrived, the transition to the cloud was smooth. Thus, both containerization and cloud migration were part of the modernization process. The system became cloud-agnostic, functioning on any cloud service provider platform and easily portable between them.

In line with Allianz's digitalization efforts, the portal's scope was expanded to include claims adjusters and medical experts, enabling them to deliver their services through the same frontend interface. New modules, such as comprehensive car insurance and a quotation frontend were to be implemented as part of the Partner Portal. This initiative also involved consolidating fragmented frontends for offers, signing and policy management.

Over the past decade, our team has not only provided ongoing support for the Portal but has also consistently implemented new functions and enhancements. This includes integration with a data mart, introduction of news and quiz functions, and development of an agent microsite system.

The Results

Business benefits

The Agent Portal has emerged as the primary communication channel between Allianz and its agents. It facilitates the dissemination of information, even mandating users to read essential news. For Allianz, the value lies in having the entire network of agents and partners accessible through a single channel, eliminating the need for email correspondence. Moreover, the system has become the central point of interaction for accessing all applications utilized by agents and other external Allianz partners, such as claims experts.

For agents and partners, the key advantage is the swift and convenient access to a vast array of information about insurance products. This expedites sales processes and reduces preparation times. An often-cited benefit is the integration and availability of all other applications and features through a unified entry point. The cutting-edge support for agents provides Allianz with several business advantages, including:

-

Increased attractiveness to young agents in a market where aging is a significant challenge.

-

Enhanced agent retention through streamlined and simplified administration processes.

-

Accelerated onboarding and training of new agents, enabling them to focus on selling sooner.

Technical benefits

-

The Partner Portal became a unified space where Allianz could consolidate their previously scattered small applications.

-

The platform effortlessly delivers new business functionality, accommodating evolving business processes.

-

It is ready to integrate third-party solutions, aiding in the elimination of vendor lock-in.

-

It is a state-of-the-art solution, built on a modern technology stack.

-

Allianz now has a cloud-agnostic system, facilitating seamless transitions between service providers.