Allianz Insurance Claim Management System (Allexa): Legacy Takeover and Replacement (2021)

The Client

With over 157,000 employees worldwide, Allianz Group is one of the world's leading insurers and asset managers, serving 125 million customers in almost 70 countries. Allianz Hungary is the largest insurance provider in the Hungarian market, offering a wide range of services to both private and corporate clients. In addition to excelling in online customer service, they are also accessible at 239 physical touchpoints throughout the country.

The Challenge: How can a core system be safely and smoothly transitioned to a new vendor in a short timeframe? How can this opportunity be leveraged for a successful system replacement project?

Phase 1: Taking over Allexa, a Core System

Allianz faced the challenge of its developer company partner, responsible for creating and supporting the Insurance Claim Management System (Allexa), suddenly going out of business and their experts becoming unavailable. Claims settlement is a critical business process for insurers, and Allexa served as the main system for this service, supporting the work of claim experts and administrators in home and automobile insurance. With thousands of ongoing claim processes and a backlog of bug fixes and change requests, it was urgent to take over support and development. Because of the short timeframe, other vendors turned down the project.

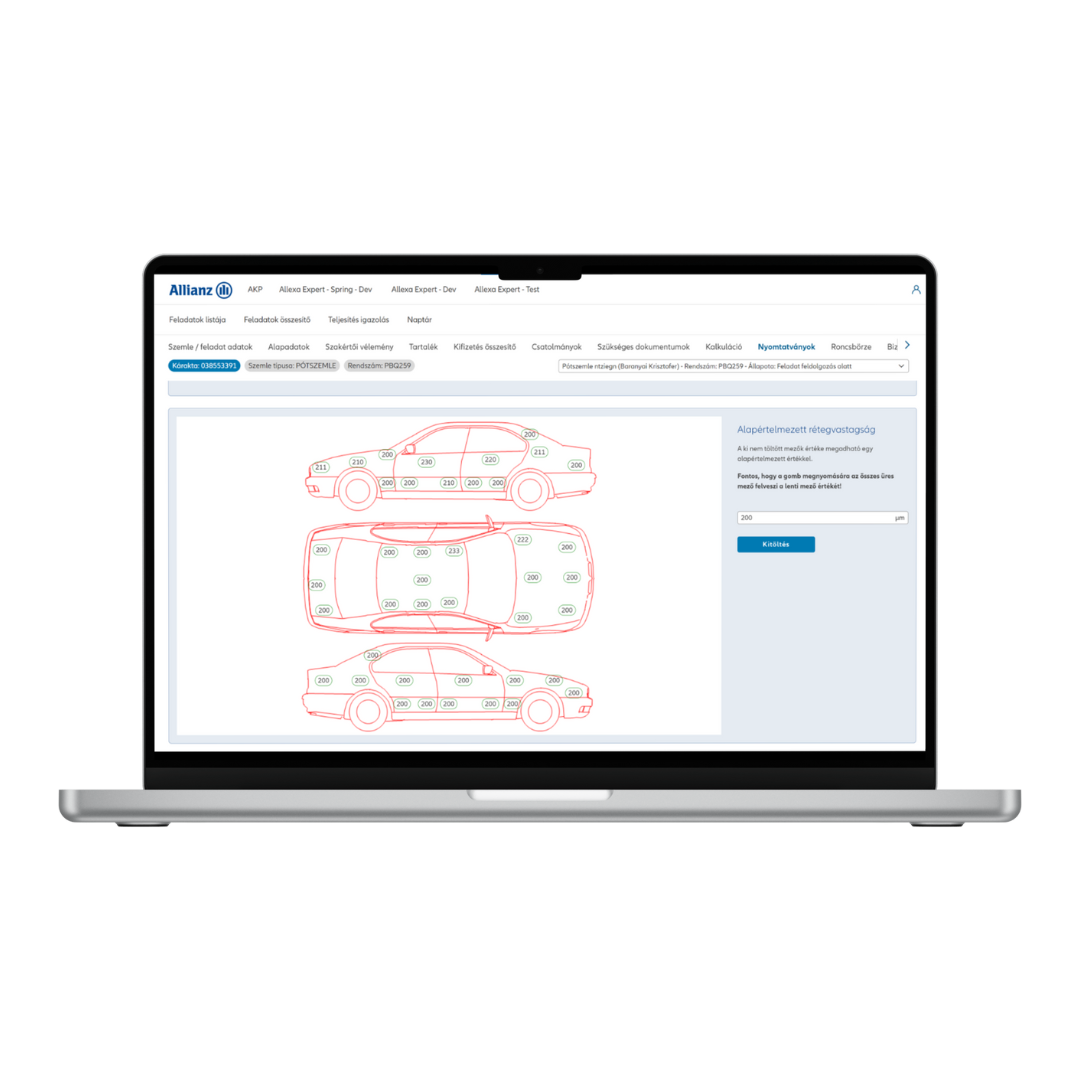

Allexa is a multi-module system: there's a repair module where auto repair shops, contracted partners of Allianz, can report damages and communicate with the insurer through an interface. Additionally, there's the expert system where car insurance claims inspectors and property damage assessors can record the results of on-site surveys and carry out expert work until the case is closed.

Our SWAT team reviewed the official system documentation and gathered information from key users about processes, functions, major entities, and interfaces. After a thorough analysis in three weeks, we concluded that we could provide bug fixes and implement minor additional functions to the legacy system. Essentially, that's what happened: we kept the system alive while the Allianz team started planning the replacement solution.

Phase 2: Enhancing Allexa: BPR and Technical Renewal

When the decision was made to replace the old system, it catalyzed Allianz to carry out BPR and rethink and streamline business processes. The new system already had many automations built in, making turnaround times faster and reducing costs. A new process was introduced, the so-called settlement branch: in case of small claims, like broken windows, the insurer avoids further costs by not sending an assessor to the scene, instead, agents can negotiate with customers over the phone up to a certain amount. This redirected a significant portion of claims to a faster, phone-based process which was a significant optimization and cost-saving action, with measurable ROI.

Allexa had a branch for a mobile claims assessment system too, which was also outdated, written for Symbian phones. We replaced this initially by porting to Windows phones, and finally to a more complex tablet-based version. We had to provide offline functionality: so assessors can still use it, even if they're at a location without mobile coverage. The system enables them to synchronize tasks from anywhere, for example, to check at the beginning of the day which sites they need to visit for damage assessment. The claims dossier should be locally accessible when they take photos, record the damage, the customer signs the report on the tablet, and then it synchronizes to the server and is automatically submitted - so if there's no mobile net at the scene, there's no problem.

In this project, there was a rescue operation, a legacy replacement, and a BPR all at once, resulting in about 20-30% cost savings in the work of the assessors. Most of this comes from the settlement branch, as there's no need to go to the scene for these cases, and there are many of them. These cases can be handled in bulk, remotely.

The Results

-

The project contributed to Allianz’s strategic initiative of strengthening digitalization, making it easier for agents to self-serve, enhancing their autonomy, reducing the need for manual work from internal back offices. These operations have been directed towards the more digital, automated channels.

-

The new system

-

successfully delivered new business functionality, accommodated new processes,

-

adapted to a completely rewritten claims module of the core system,

-

gradually replaced the old system, without operational disturbances,

-

brought a stunning user experience that eliminates resistance to change.

-

The operation of claim processes remained uninterrupted, and the system remained stable and operational. Bug fixes and required changes were implemented seamlessly.

-

Allexa now operates on an up-to-date technology stack.

-

Our team transferred its knowledge to Allianz, assisting them in refining their development framework, enabling development work to proceed smoothly without being locked into any specific vendor.