Development of corporate pricing module in a containerized environment

The Client:

CIB Bank delivers products and services that make life and finances easier for more than 420,000 customers. The support of parent company Intesa Sanpaolo and experience of four decades have helped contribute to the implementation of our customers' plans.

The Hungarian unit consists of:

~ 2,000 employees, ~60 branches, ~400,000 customers

The Challenge:

developing a corporate pricing module in a containerized environment CIB Bank aimed to develop an integrated frontend solution to support its corporate lending process. The module initially aimed to implement workflow development to support pricing. In order to achieve this, the bank was looking for partners. The corporate pricing area is one of the most complex business domains in the banking area. Banks are usually overly cautious about adopting the latest technologies. In that period of time, there was very limited, if any, experience in the banking sector operating in a containerized environment.

The Solution:

We participated in the development of a consortium with a partner company. The customer was looking to replace several systems with one closed, auditable fast solution, one with a higher level of automatization, providing consistent data, and acting as a master source for corporate lending data.

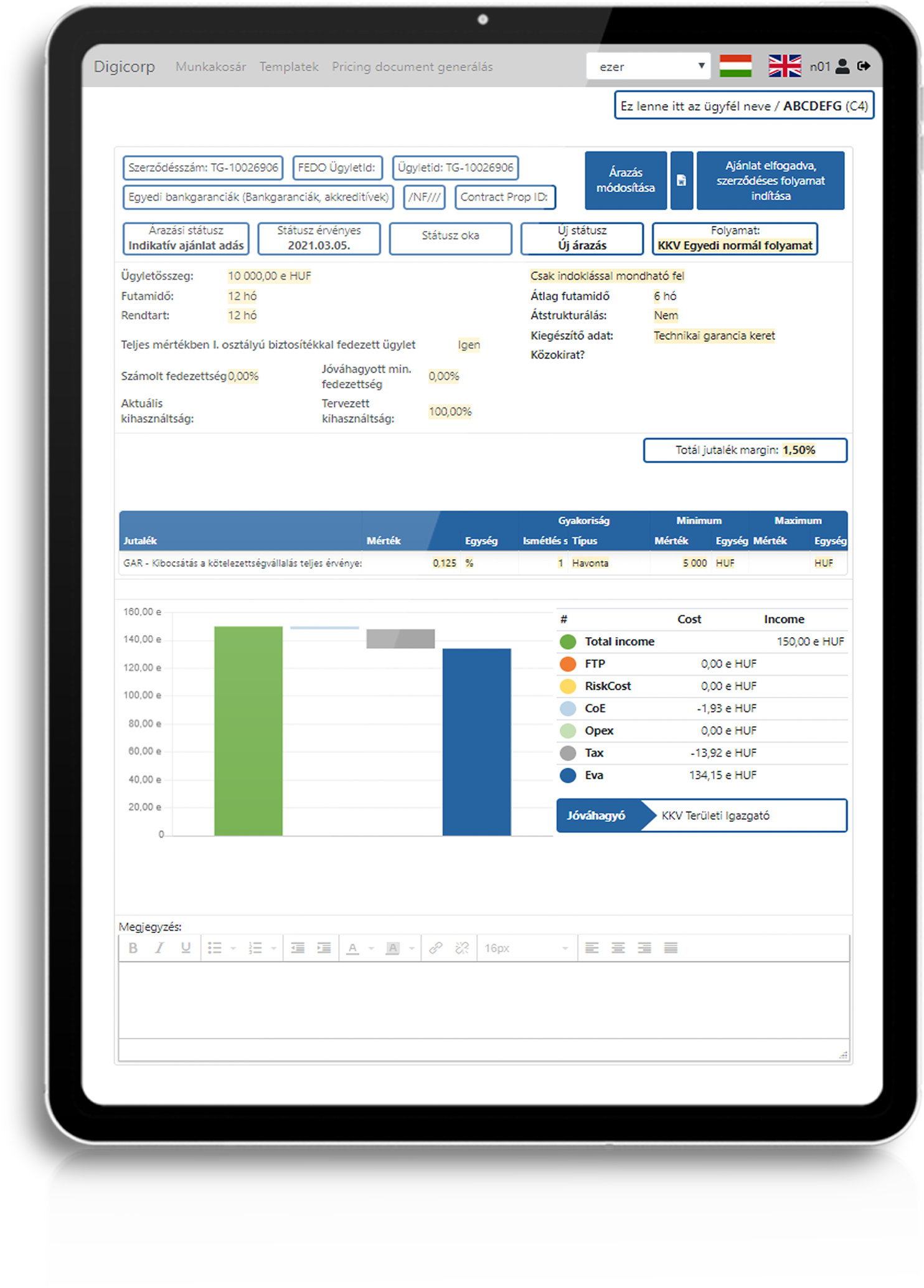

Pricing module for supporting the corporate lending process by:

- collecting customer data,

- supporting the entire approval process with WorkBasket and Workflow management, complex approval level management,

- preserving snapshots of the entire data set to be viewed afterwards from past actions,

- displaying an immense amount of data in a clear form for an administrator with swift response times,

- showing all relevant bank transaction details of the customer,

- creating a product book with all corporate active and passive products of the bank,

- generating documents based on templates to be parameterized by the business area without IT and supplier support,

- implementing an Investigation module with several internal and external integrations (e.g. company information services, credit bureau).

The development began on a J2EE solution, but based on the long-term advantages, the Bank afforded us the opportunity to rewrite it to Spring, with React client technology. The Bank was open to modern solutions not only in Java technology, but also in terms of used runtime environment. Together with the Bank's operation specialists, we managed to create a containerized, Docker environment.

The Results:

The result was one system providing faster ‘time to yes’ with a streamlined process. This outcome turned out to be quite cost-effective for the client as they then needed fewer human resources from the officers, and were provided with more effective operation possibilities. The pricing module is live and successfully supports the Bank's corporate sales. CIB Bank plans to move towards supporting the entire corporate lending process according to its roadmap together with us.

The LinkedIn post of the Business Architect: