Preserving long-standing values during technology change

The Client:

CIB Bank delivers products and services that make life and finances easier for more than 420,000 customers. The support of parent Intesa Sanpaolo and experience of four decades have helped contribute to the implementation of our customers' plans.

The Hungarian unit consists of:

~ 2,000 employees, ~60 branches, ~400,000 customers

The Challenge:

How to replace the technology of a Bank’s portal while preserving the values of legacy solutions? “Project mission statement: If there is a Frontend heavy development, the bank wants to say with full confidence, that we should use this technology, this way, with this design, because: there are available developers, it is maintainable, the technology is future proof, and we know how to deal with existing applications.” When the project was started, the Bank’s portal solution was based on an outdated, unsupportable technology. Finding experts for maintaining such an outdated portal proved to be quite the challenge. The bank decided to implement a new, future-proof solution, while finding a solution to keep the values of legacy systems, developed throughout the years. The scope of the project was to create a feasibility study and a proof of concept.

The Solution:

For the feasibility study we examined the state of the system with:

- Review of documentation to better understand the complexity and functions of the current applications

- Conduct interviews with the main stakeholders and experts to shed light on issues originally overlooked and bringing new information to the surface through professional expertise and experience

- Devising a survey about the problems of the developers, and to explore their preferences to gain insight into the difficulties of the current system

- Reviewing the source code itself to cross-check the information received and verify the current operation of the system.

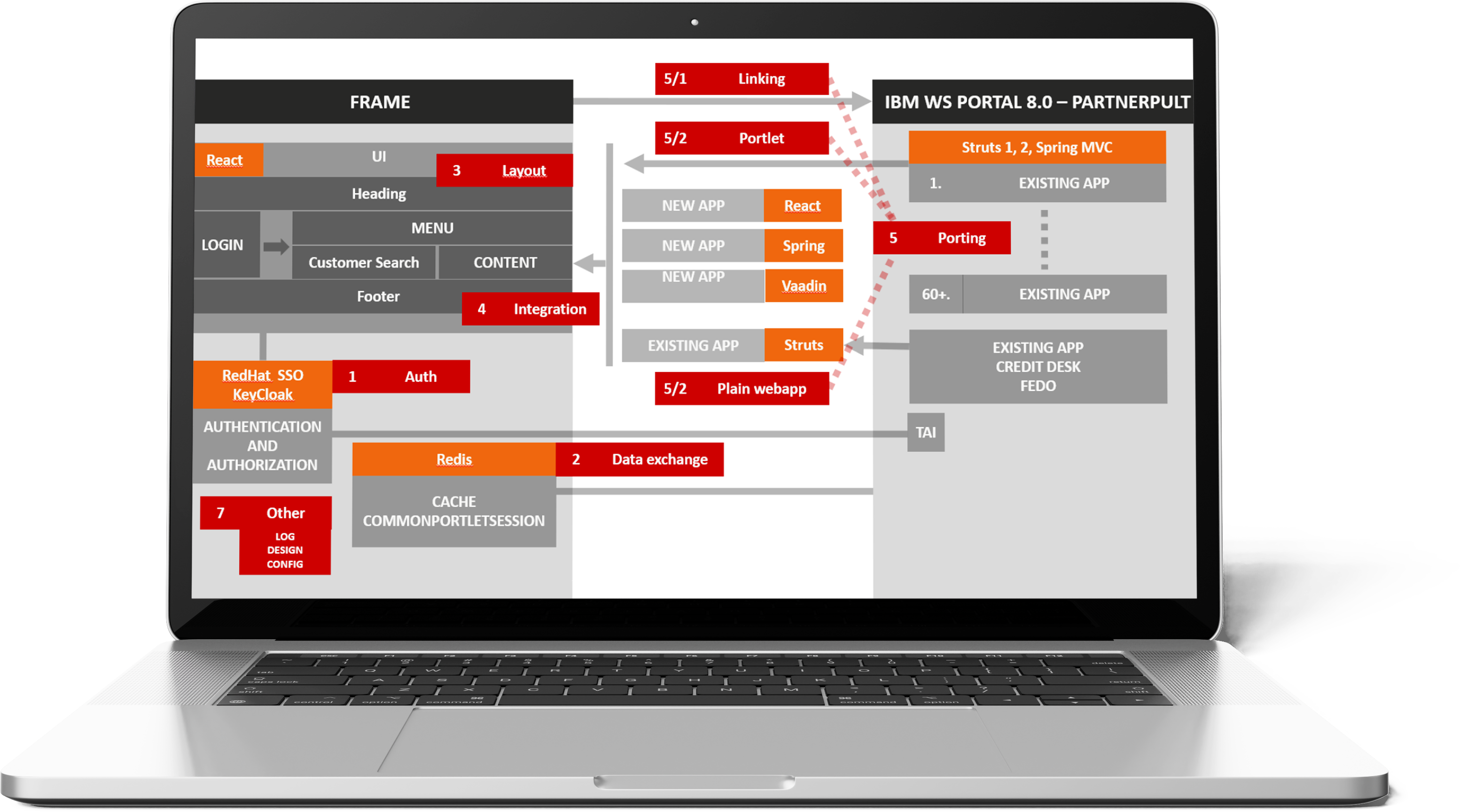

During the evaluation it became apparent a solution was required to enable gradual roll-out, so that the new environment and the old portal environment could harmonize for a few years while not inconveniencing the end users.

For the proof of concept, we assessed and compared the possible technological directions and made a proposal for the most suitable technology for the Bank's needs. Once the evaluation was completed, we put forward our proof of concept to CIB on the direction to take based on a set of guidelines addressing suitable technologies available at hand and within budget and time constraints.

The Results:

Proofing our concept, we:

- developed a new software frame to potentially replace the previous Portal System. Our new frame supports old and new applications at the same time, with a possibility of exchange data among them,

- inspected the possibilities of porting applications into the new frame. We ported 3 of them. In one case the backend remained completely unchanged,

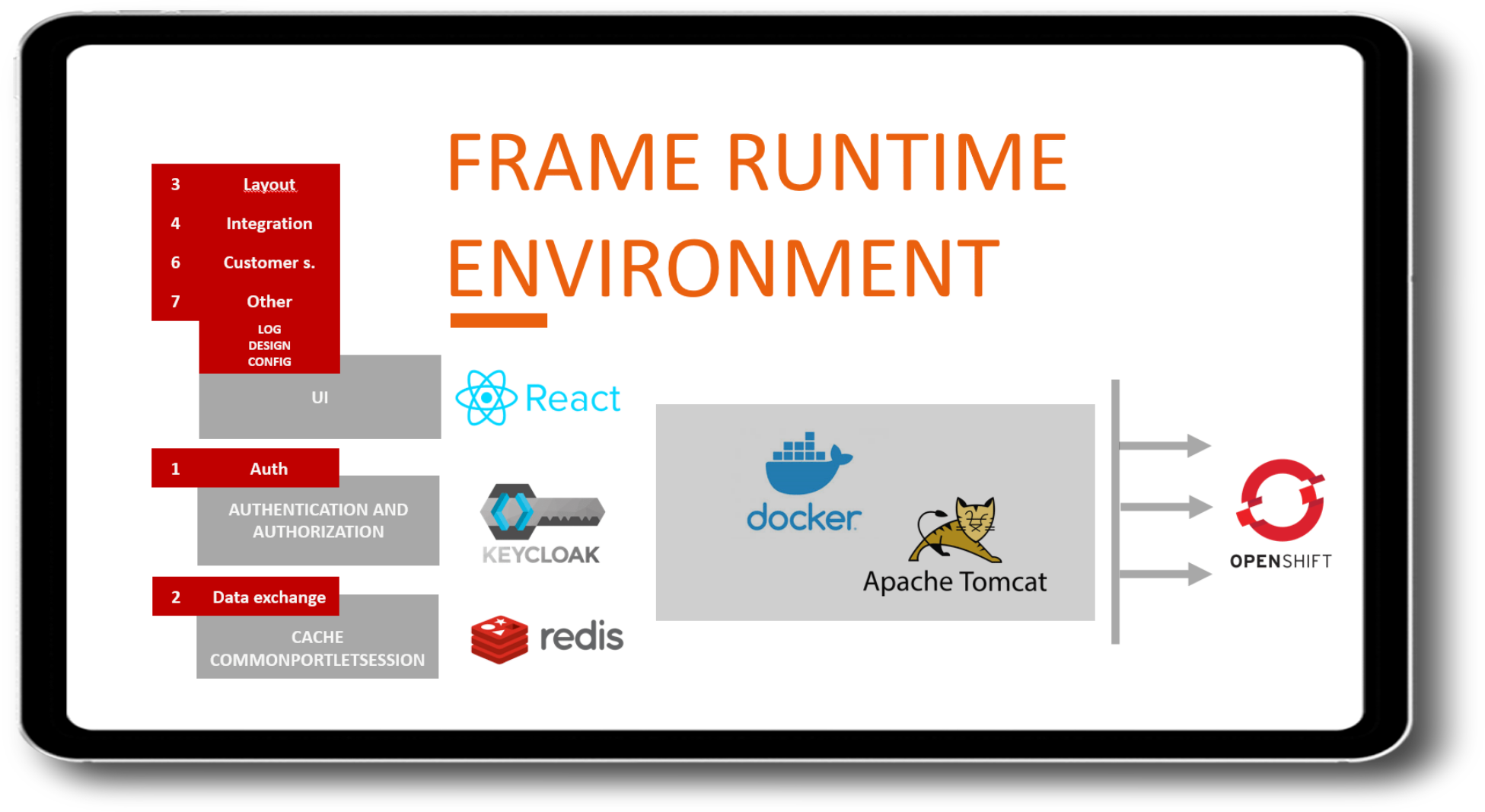

- (infrastructure-wise) prepared the portlet to run in a cheaper Tomcat environment instead of WebSphere - with Docker Image & Openshift.

As part of the Framework, we proposed a Single Sign ON (SSO), cache management and configuration solution for the future portal infrastructure. In cases in which customers carry out a step-by-step portal migration, an SSO solution is necessary to avoid multiple logins to different applications. Central cache management can help data exchange between applications (e.g. customer master data). Proper configuration is necessary to maintain a stable runtime environment in similarly complex systems.

We prepared a complete, detailed, executable roadmap taking into account logical groups and priorities and several aspects, how to rewrite the existing components into the new framework:

With our help, the Bank achieved its goal - the new frontend exhibits a future-proof, modern technological direction making it far easier to find developers. Danubius also found a solution in having the traditional tech environment continue to operate in parallel with the new solution. In addition, the bank also received a guideline and a roadmap on how to move its existing applications to the new world.