Streamlining backend services for banking applications: outsourcing and integration

The Client:

Raiffeisen Bank Zrt. is one of the leading players in the Hungarian financial market, with more than 35 years of experience. Raiffeisen Bank International AG (RBI), the bank holding company of the bank, is one of the most important corporate and investment banking service providers in Central and Eastern Europe. Raiffeisen Bank employs more than 2,000 people in Hungary and has 66 branches nationwide.

The Challenge: "Outsourcing the services of the backend system supporting the onboarding process to other banking applications."

The main goal of our previous collaboration was to drive more customers to lower total cost of ownership online platforms. The success of the project is demonstrated by the fact that once the next business objective was defined, there was no question of whether the Danubius team would remain a partner for the remaining duration of the project. The ensuing development was to extend the services of the backend system supporting the onboarding process to other banking applications (online personal loan application and mobile banking application). In designing the new process, it was imperative to keep the maintenance of business data in one place, making it much faster and safer to track changes.

Our mutual technology goal was to move away from the on-premise infrastructure and be one of the first in the Bank to make services available on AWS cloud infrastructure. An important consideration was to ensure that the integrity of the current live system was not compromised. To achieve this, and to support the different needs of projects running in parallel, development was aligned in two branches.

The Solution:

In order to make the application future-proof, we ported the backend to Spring, replacing the WebSphere Application Server and smooth out the infra. As the application was being ported, integration tests were introduced to ensure the quality of the software. Numerous other applications were integrated with the already springing application and we went on to switch to contract first development.

This way of working ensured that related systems could use the same interfaces from the start of their development. We implemented channel-dependent management logic, i.e. the backend only passes the data required by the system, to support the related systems.

This in turn affords us more opportunity to carry out smoother integrations for the clients. These contracts were overlaid on AWS API Gateway using the bank's proprietary CI/CD system. We also completed the containerization of the application.

Alongside the integration, the Bank was also redesigning its business process, and some of our services had to be further developed. New services had to be created and offered. In light of these transitions, efficient cooperation and support of the partner areas and the various ongoing projects were key aspects throughout the development.

We also took on an additional role in supporting Raiffeisen in coordination tasks. In order to ensure consistency with the current onboarding process on all platforms, some of the validations previously performed on the frontend were moved to the backend. For further consistency, we introduced centralized product parameterization, which required changes to the database structure currently in use.

The Results:

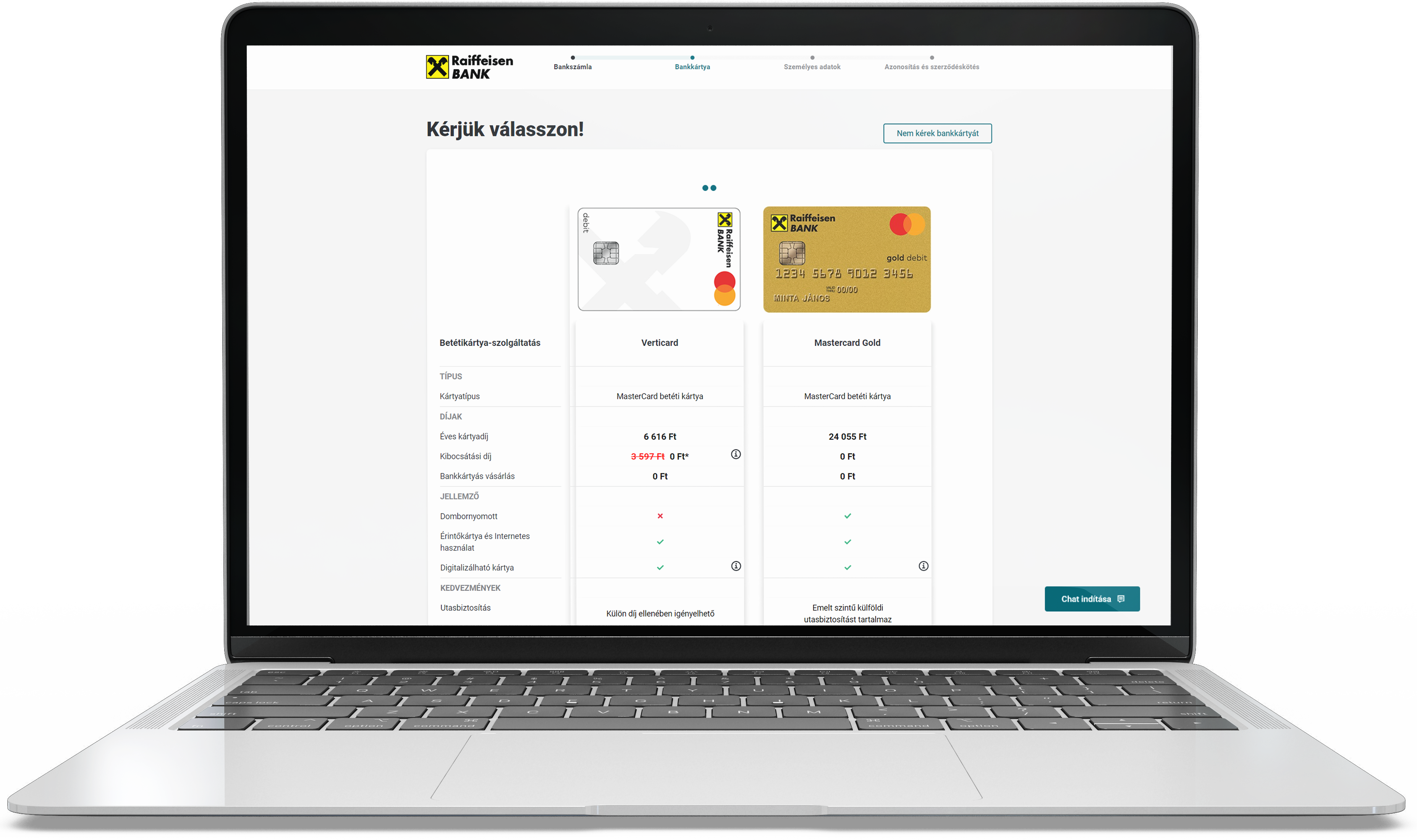

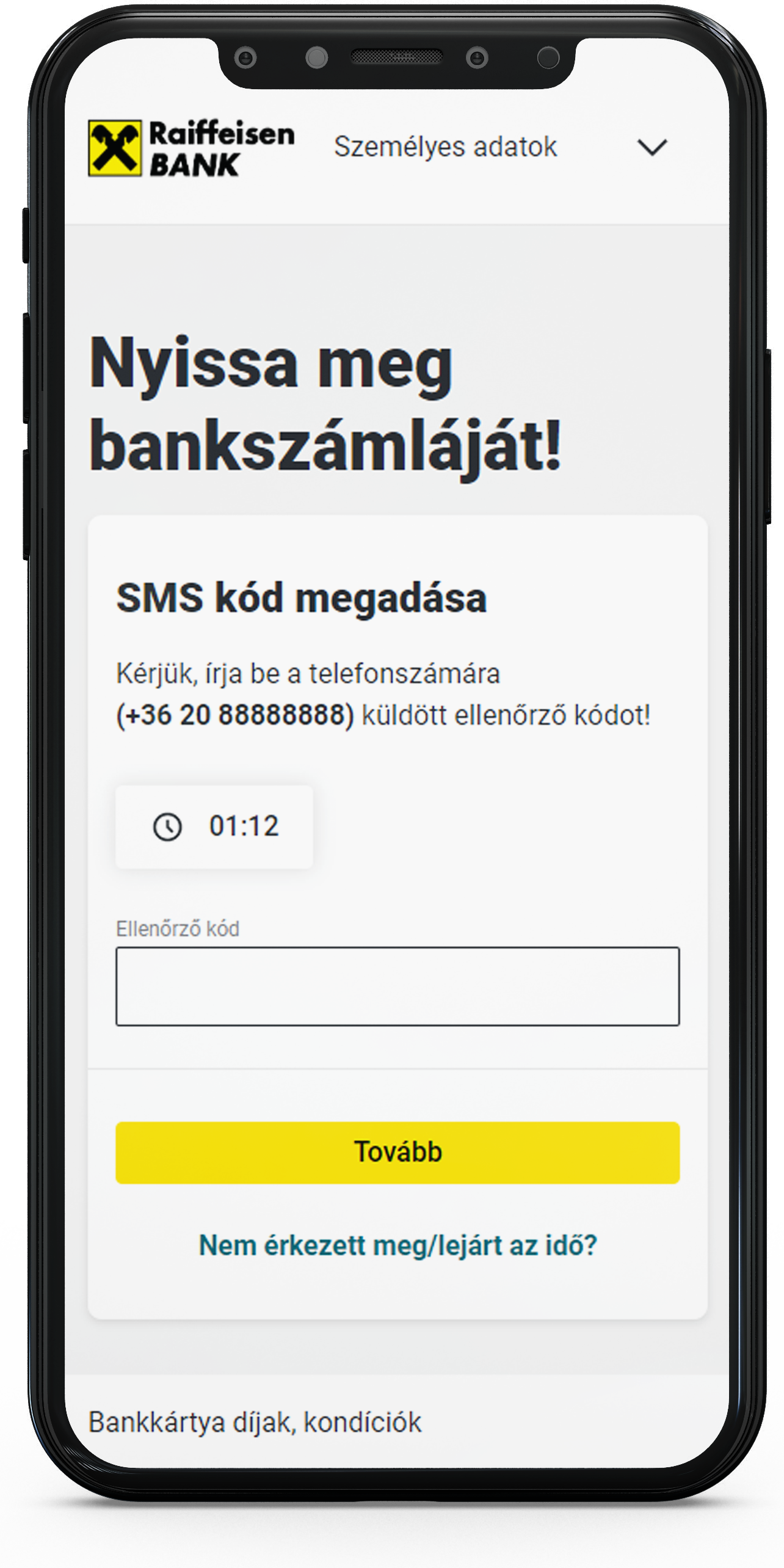

- The services offered to customers have become more customer-friendly. Customers have been able to open a new account online while simultaneously being able to take out loans.

- The technology change has provided us with a more reliable, modern system.

- By being one of the first to migrate to the AWS cloud infrastructure, Danubius assisted the Bank in setting up a smooth transition process for the future.

- The new data structure has improved the performance of the application overall.

- The unified parameterization allows changes to be handled in one place, avoiding changes on the client side. This makes the whole process more expeditious as a whole.

"They develop efficiently and precisely with very high craftsmanship. In addition, we can also count on their professional support and ideas, their proactivity significantly accelerated our developments.”

Gábor Oláh, Digital Development Head, Raiffeisen Bank Hungary